Finance

Memorandum from Mayor Miro Weinberger to the City Council

Re: Fiscal Year 2024 Proposed Budget

June 20, 2023

As with the past three budget years since the pandemic, FY24 revenues and expenditures have once again proven very complex, ever-evolving, and difficult to project. In some ways, this is the most difficult of the pandemic-era budgets and many of the challenges that shaped this year’s fiscal strategy will ripple into the future.

In recent years, a significant infusion of one-time federal relief dollars helped balance dramatic revenue shortfalls driven by the pandemic, enabling us to restore City operations and make progress on numerous equity initiatives.

This year, our major budget challenges are driven by lingering pandemic impacts on City revenues, severe and sustained inflationary pressures which have increased City costs across all operations, and our commitment to minimize cost impacts on residents as Burlingtonians continue to face uncertain and challenging economic times.

To answer these challenges, this budget implements a creative combination of one-time funds, repurposed reserves, non-service or personnel-related cuts, and a modest tax increase pursuant to the City Council Charter Authority to properly fund Parks and Recreation (the Parks tax rate has remained at or below the current rate of .025 since FY14).

FY24 Budget Principles

The Administration began the FY24 budgeting process by laying out principles that would guide our work to develop the budget. Those principles were:

- Restoring public safety through rebuilt and expanded Burlington Police Department and additional public safety resources is top priority of the budget.

- Minimizing increases to property tax burden as constituents and Burlington businesses recover from pandemic and absorb costs of new high school.

- Retaining current City employees through the volatility of the pandemic and recovery continues to be a high priority as it has been since 2020.

- Continuing historically high level of public infrastructure investment as in all years since 2016.

- Cuts are focused on non-personnel budget lines.

- Few, if any, new initiatives can be added to the structural budget this year unless funded externally.

- We will need a multi-year plan to address the challenges that are coming into focus as we emerge from the pandemic.

- We will continue to invest heavily in addressing the climate emergency in significant part through expanded BED efforts.

- Additional new federal and state opportunities are available and we continue our expanded efforts to apply for them.

Now, at the conclusion of the process, the budget that we have submitted reflects all of these principles. The General Fund Budget makes significant investments in a rebuilt and expanded police department, retains current City services and employees, and maintains historic levels of infrastructure investment – while minimizing property tax and fee increases as Burlingtonians and local businesses work to recover from the pandemic and absorb the debt burden of the new high school.

I would like to recognize the work of our Chief Administrative Officer, Katherine Schad, who has led the budget process, members of the Clerk Treasurer’s Office team, especially Jason Gow, City Department Heads, and their teams, who worked diligently towards our common goals to deliver this budget.

A Challenging Budget Period

Factors contributing to challenges in the FY24 budget, and likely future years, include:

- Inflation-driven COLA increases across all unions for FY23 and FY24 add substantial costs to the operating budget.

- Increases to most of the City’s non-personnel operating costs are driven by significant and sustained inflation rates (an average of 8.0% across all months in 2022, and 5.26% across the first 5 months of 2023).

- We are in the third and final year of phasing out federal support for dramatically expanded city-wide equity initiatives, including the creation of the Racial Equity, Inclusion, and Belonging (REIB) Department, paying board and commission members, our language access program, and paying all City employees a livable wage. In FY22 the General Fund budget allocated $2.76M to launch these initiatives, the FY24 the budget commits only $800k of federal dollars to REIB and $170K to CEDO to support these initiatives.

- Pandemic-impacted revenue shortfalls persist across numerous sources, such as boat slip rental at the waterfront and parking across the City.

- Our largest revenue source, property taxes, can only increase by 1) growing the Grand List (which historically drives a <1% increase in tax revenue per year) or 2) voter-approved tax rate increases.

- Rebuilding of police officer ranks (in alignment with the Rebuilding Plan, the budget assumes 7 additional officers in FY24), hiring three new firefighters, and fully staffing the CSL (6) and CSO (11) programs, also contribute to considerable public safety cost increase.

Process & Solutions for a Full-Service Budget

This budget includes many initiatives proposed by Councilors during the budget process and in meetings that took place over the course of the last six weeks including rolling over unspent councilor initiative funds from the prior-year budget, increased funds for lobbying for City initiatives during the legislative session, and increased patching and paving in the 2024 construction season.

Voters have not increased the municipal tax rate since an increase since the Public Safety tax was approved in March 2020 and implemented in the FY22 budget (which was used to pay for the cost of adding a third ambulance crew). Level funding a full-service budget amidst a high inflationary environment and without significant new federal funds or a commensurate increase in the tax rate created real challenges to this budget process.

To solve for these challenges, the FY24 budget implements the following solutions:

- As in FY23, we are assuming that pandemic-impacted revenues continue to strongly rebound, and we are continuing to carry a $1 million ARPA-funded Revenue Replacement Reserve for revenue shortfalls.

- Department Heads level-funded all operating budgets with few exceptions (ambulance supplies, diesel fuel, etc.) and all Departments maintain current staffing levels, the only new hires are in public safety positions.

- Use of City Council Charter Authority to sufficiently fund public parks and recreation, and paving and patching.

- Repurposing of unspent FY23 Revenue Replacement Reserve and other reserves to fund the first year of multi-year plan to phase in new Public Safety costs into the structural budget.

- Use of one-time funds to address one year of vehicle needs.

- Approximately $750,000 of additional cuts and adjustments.

Increased Public Safety costs are driving a significant portion of the year-over-year budget increase. This pressure will increase in the next two budget years as the Rebuilding Plan is implemented and as police officer ranks approach the authorized headcount as detailed in the “Stabilized Budget” projection included in the BPD budget presentation. In order to continue our momentum in the Rebuilding Plan, the FY24 budget relies on $1.3 million of federal funds. In order to complete the rebuilding of the department we will need to phase these costs and the projected future cost increases into the structural budget over the next couple of years.

Furthermore, in 2022 the City created two new positions in the Clerk Treasure’s Office to support primarily General Fund departments in their collective efforts to compete for new and ongoing state and federal grant funding opportunities, to more aggressively reduce financial burdens on property tax revenues, and to grow new and underfunded initiatives. In FY23 the City leveraged $212,000 of City funds for more than $2 million in non-federally funded projects and received $107 million in federal awards across all City departments.

The Grants team has made $26.5 million in further requests which are pending, and anticipates opportunities ahead in FY24 to seek state and federal support for major infrastructure projects including the QCPR bridge, Great Streets improvements in the Downtown, and in various city parks, as well as for programs including REIB’s planned Neighborhood Equity Index, workforce development, public art, planning, and public health.

Significant Public Investments in FY24

Despite the major challenges detailed above, the FY24 budget avoids any service cuts, layoffs, or hiring freezes on existing positions and will continue to forge critical progress in our highest priority areas, including:

- Robust investments in green stimulus incentives for BED ratepayers and work underway to ready the electric grid for future increased electricity demand will continue, funded in part by the voter-approved $20 million Net Zero Energy Revenue Bond passed in 2021.

- Expanded resources, recruitment tools, and new hires for public safety, including $1.3 million of increased BPD personnel costs and $950,000 of increased BFD personnel costs.

- Major public infrastructure investments supported in large part by the 2022 voter-approved Capital Bond, federal and state awards, and more than $1 million in Street Capital funds for paving and large patching repairs, including an additional $282,000 (for approximately 1/3 mile of full-width paving) beyond the 2.3 miles already planned for FY24.

- New deployment of $183,000 in annual Opioid Settlement funds to support the City’s expanded efforts to advance harm reduction and expand access to MOUD treatment and contingency management. The City has signed two settlements that will provide steady funds over more than a decade and is expecting to sign more agreements in FY24.

- A $1.7 million budget for the REIB Department which includes the elimination of any temporary or limited services positions and the structural reorganization of 10 full-time employees to advance the Department’s key initiatives, including cultural events, programs to address racism as a public health emergency, the continuation of the Empowerment Fund, and the planned Neighborhood Equity Index.

Finally, I want to note that the Regional Programs budget includes $15,000 for the construction of the Children of St. Joseph's Orphanage Memorial. The memorial is one of a number of important, restorative initiatives being taken in the wake of the investigation of the orphanage that the City helped launch in 2015 and will be added to the $10,000 of councilor initiative funds that the Board of Finance has already approved. You can read more about this memorial here.

Property Tax Rates

The General Fund Budget is level funded and holds the overall increase in City expenses below the average rate of inflation for 2023 to date, which is 5.26% (the current rate of inflation is 4%).

|

|

FY23 Amended Budget |

FY24 Proposed Budget |

Year over Year Increase, dollars |

Year over Year increase, percent |

|

Revenues |

$98.0M |

$101.1M |

$3.1M |

3% |

|

Expenses |

$97.4M |

$101.1M |

$3.7M |

4% |

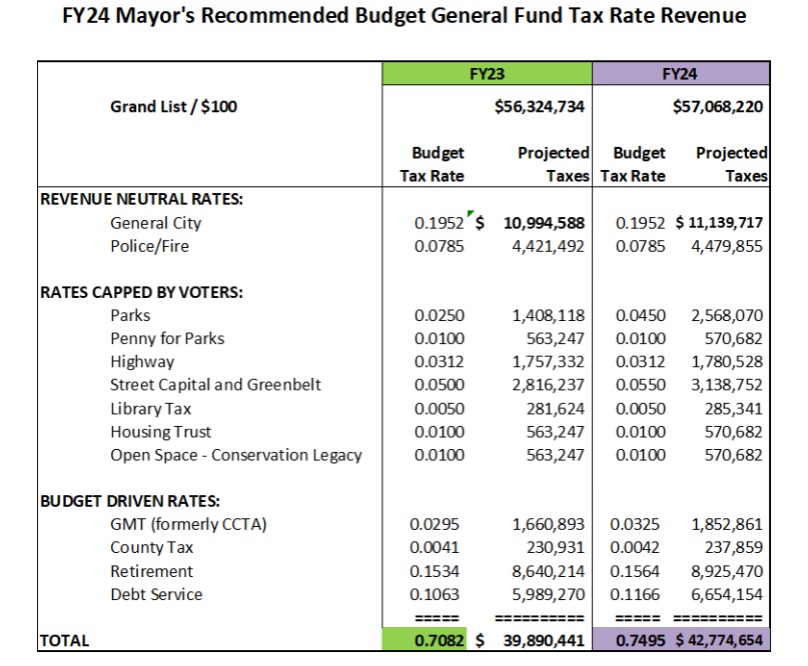

The proposed FY24 budget will require an increased tax rate of $.7523 from the FY23 tax rate of $.7082 -- or an increase of 6.2%, which is comparable to this year’s projected State Education tax rate increase. This includes an addition of $.005 to the dedicated Street Capital and Greenbelt tax to increase patching and paving in the 2024 construction season, and an additional $.02 to the dedicated Parks tax which will generate an additional $1.1 million of revenue to pay for BPRW expenses the City is already incurring.

As prescribed by Charter, the dedicated Retirement and Debt Service taxes are adjusted annually to meet the needs of those funds. The proposed budget also increases the Business Personal Property Tax exemption from $45,000 to $75,000.

The total year-over-year increase in the municipal property tax rate represents a $13.60 per month, or $163.20 per year, increase for homeowners with a home with median tax assessed value of $370,000.

Looking Ahead to FY25 and Beyond

Many of the financial pressures we faced this year are likely to continue and intensify in the future. To plan for future budget years and maintain the City’s commitments to equity, good fiscal health, and to minimizing financial burdens on ratepayers and taxpayers, numerous operational analyses and studies are planned.

Following the most recent citywide appraisal, the Planning Department initiated a revenue and equity analysis now being conducted by an outside firm to map the financial health of built environments in Burlington in order to understand which areas of the City are the most underperforming from a valuation perspective, but simultaneously have the most tax revenue potential for redevelopment. This work will be completed in FY24 and will inform future budgets, land use policy reforms, and City planning to support the equitable and sustainable growth of property tax revenues.

In addition to the revenue and equity analysis, and ongoing work by City staff to complete an updated Capital Investment Plan and review our current Franchise Fee ordinance, the FY24 budget includes:

- $50,000 for a Fleet Management Study to establish sustainable funding for City vehicles.

- $75,000Kor operational analysis of City operations to ensure functions aren’t duplicated across the City and to increase inter-department efficiencies.

- Continued support for the Impact Fee Study (for which the City allocated $100,000 in FY23) so that a leading expert firm can advise the City and CCRPC on an update of our impact fee program.

- Funding provided by HUD for no-cost technical assistance to complete a Financial Sustainability Study for CEDO.