FOR IMMEDIATE RELEASE

July 29, 2019

Contact: Olivia LaVecchia

(802) 734-0617

City of Burlington Receives Two-Notch Credit Rating Upgrade from Moody’s Investors Services

The upgrade follows years of work to rehabilitate the City’s finances, and fully restores the “Aa3” rating that the City held prior to Burlington Telecom-related downgrades

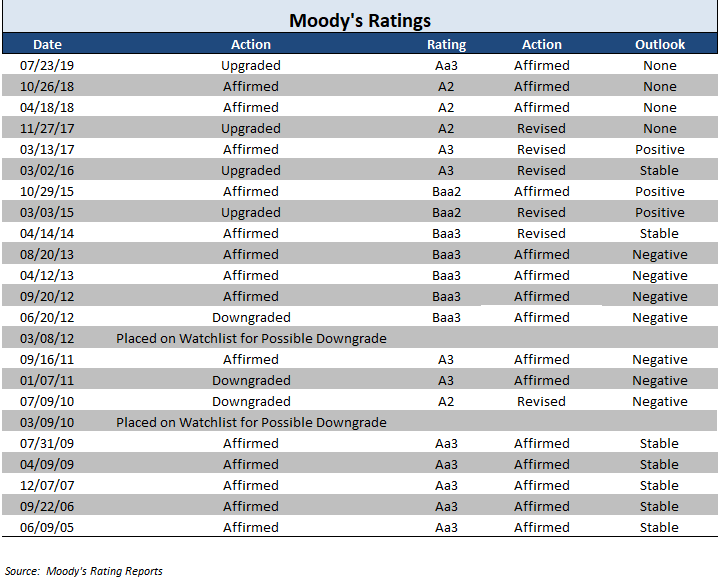

Burlington, VT – Moody’s Investors Services upgraded the City of Burlington’s credit rating from “A2” to “Aa3,” marking the full restoration of the credit rating that the City last held ten years ago. Even before this upgrade, Burlington’s financial turnaround since 2014 had locked in savings for taxpayers and ratepayers of over $17 million (additional information below). In the future, these savings will increase even more quickly every time the City issues new bonds. For example, in the upcoming months alone, the City will lock in an estimated $952,000 in savings over what it would have spent in 2012, and potentially more, on the approximately $13 million of general obligation bonding that the City is planning for this fall.

“Nearly eight years ago, as a candidate for mayor, I stood on the steps of City Hall and announced a financial plan that made clear that restoring the City’s fiscal health would be my top priority as mayor,” said Mayor Miro Weinberger. “With last week’s upgrade, following much hard work by the Administration, the City Council, and many others, we have fully delivered on that promise. As a result of these upgrades, we are keeping millions of dollars here in Burlington that would otherwise be sent to Wall Street, and using that money to make necessary investments in public goods. We have been able to achieve this without service cuts or major tax increases thanks to the support of Burlington voters, the innovation and commitment of our management team, and the collaboration of our public employee unions. Today, we are celebrating the completion of our financial turnaround and a major step as a community toward a more effective, affordable, and healthy City.”

Moody’s decision to upgrade to “Aa3” impacts the rating on $88 million of outstanding debt. In its report, Moody’s Investors Services highlighted the resolution of the Burlington Telecom litigation in March 2019, the City’s strong reserves, and the City’s “experienced management team.” “The current management and governance team has a strong record of conservative budget management and proactive policies that have benefitted the city financially,” the report notes, “evidenced by the resolution of the Burlington Telecom litigation and building of a strong reserve position.”

Work to Restore the City’s Financial Health

This credit rating upgrade is a result of diligent work over the past seven years. That work has included:

- Voter approval in November 2012 of the $9 million Fiscal Stability Bond, which eliminated the City’s need to rely on short-term borrowing and provided a foundation on which the City was able to build a stronger financial position;

- Successful negotiation in 2014 of a settlement agreement of the $33.5 million Citibank lawsuit on terms favorable to Burlington taxpayers, and successful implementation of that agreement culminating in Citibank’s full release of the City from liability upon close of the sale of Burlington Telecom in March 2019;

- Conversion of a 2012 unassigned fund balance of negative $15 million into a surplus of over $9.7 million at the end of Fiscal Year 2018;

- Elimination of multi-million dollar fund balance deficits in the Water and Sewer Enterprise Funds;

- Improved financial operations at the Burlington International Airport and Burlington Electric Department;

- Years of operating surpluses, as a result of improved financial reporting, identification of new and expansion of existing revenue sources, a continued City-wide focus on cutting expenses and collecting receivables, and budgeting practices that include ensuring contingencies for unexpected expenses;

- Improved internal controls and financial management practices that have resulted in the reduction of audit deficiencies from 27 in 2012 to four in 2015 to zero in 2018;

- The creation of a City Council Fund Balance policy and commitment to long-term infrastructure and capital asset planning; and

- The creation of the City’s first-known debt policy, which outlines a target and a maximum for the amount of General Obligation debt that the City can incur, and which the City Council unanimously adopted in September 2018.

Savings for Burlingtonians

A city’s credit rating directly impacts the interest rates that the municipality pays when it issues new bonds. As a result of credit ratings upgrades received since 2014, the City has already locked in savings on debt with an estimated net present value of more than $17 million on new bonding completed since 2014 (see Clerk/Treasurer’s Office’s March 2019 Fiscal Health Report; these savings are estimated relative to what the bonds would have cost with the City’s 2012 “Baa3” rating).

As a result of the City’s financial recovery, Burlingtonians will save an estimated $73,000 over what they would have spent in 2012 on every $1 million of debt that the City takes on. In coming years, as the City takes on new debt to make historic investments in a new high school, water systems, and other vital public infrastructure, these savings will grow dramatically. As an example, for the $70 million in spending on high school construction that the voters authorized in November 2018, this upgrade translates into a savings of approximately $5.1 million in interest costs over the 2012 rating.

Additional highlights from the Moody’s report include:

- “Burlington benefits from a growing and strong reserve position and very strong cash position. This is supported by an expanding tax base which incorporates the city’s strength as the economic, higher education, and medical center of Vermont.”

- “The resolution of the Burlington Telecom litigation highlights an experienced management team and eliminates significant financial risk.”

- “Going forward, the city is focused on maintaining a stable credit profile while addressing the challenges of rising fixed costs with a growing debt burden and pension expenses.”

- “Additional strength is added with a strong entrepreneurial focused business culture. Additionally, the city has won awards for its environmental sustainability practices and policies including being the first city in the country to provide 100% renewable electricity to its residents.”

- “While the city continues to improve policies and grow the affordable housing stock it remains an ongoing challenge given current demographics.”

- “The city has also settled contracts with all its unions with expiration dates in June 2022 and has worked with the union to share health and pension costs going forward.”

Background

Between July 2010 and June 2012, following the disclosure of Burlington Telecom’s financial struggles and other fiscal instability, the City of Burlington received credit rating downgrades totaling six steps. By June 2012, the City’s credit rating was “Baa3” with a negative outlook, placing it on the verge of junk bond status. Mayor Miro Weinberger was elected in April 2012 with a commitment to improving the City’s financial standing, and in April 2014, the City received its first of a series of credit ratings upgrades, culminating with Moody’s decision to upgrade the City’s credit rating two steps to “Aa3” in July 2019. With this two-notch upgrade, the City has regained all six steps that it lost, and completed its financial turnaround.

Reactions and Support

"Setting this City on solid financial footing has been the focus of this Administration for the last seven years,” said City Councilor Joan Shannon, South District. “Today, City residents should be very proud that we are nationally viewed as a well-managed City, thanks to the leadership of the Mayor and his Administration with the collaboration of the City Council, City staff, the unions, the school district, and the residents of Burlington who have voted in support of fiscal stability and investing in our decaying infrastructure. Burlington has strong social and environmental values, but without fiscal stability we do not have the money to invest in those values. An improved credit rating lowers the cost of borrowing and allows the City of Burlington to pursue the priorities of our residents and make Burlington a cleaner, healthier, and kinder City.”

“The two-notch upgrade is exciting news that will result in direct savings to all taxpayers, in both their municipal property taxes as well as their education property taxes,” said Beth Anderson, the City’s Chief Administrative Officer. “This upgrade is the result of years of focus and hard work by staff across the City. This work was carried out not just in day-to-day fiscal operations, but also in the development of financial management policies and controls that will serve to continue the improvements in years to come.”

"The financial turnaround of the city under the leadership of Mayor Weinberger, and the financial turnaround of the school district under the leadership of Superintendent Obeng and the Burlington School Board, has been extraordinary,” said Clare Wool, Chair of the Burlington School Board. “As we embark on $70 million high school renovation, this improved credit rating will reduce the cost of borrowing and translate into real savings for Burlington taxpayers. Prioritizing and managing our city finances with the utmost professionalism shows the ultimate respect to our taxpayers – you, the citizens of Burlington."

"The Burlington Businesses Association welcomes this continued improvement in the City’s credit rating,” said Shireen Hart, Chair of the Burlington Business Association Board of Directors and Shareholder and Director at Primmer, Piper, Eggleston, and Cramer. “Moody's has once again recognized the responsible fiscal stewardship of Burlington under the current Administration. Our “Double A” credit rating means the city will be able to finance the necessary work to maintain and improve our city at lower borrowing rates, ultimately saving taxpayers money. Much like a personal credit score of 750 or higher, this credit rating shows that Burlington is strong and poised to grow.”

For additional information, please see:

- Below photo of July 29 announcement

- November 29, 2017: “Moody’s Investors Service Upgrades Burlington’s Credit Rating to ‘A2’”

- March 3, 2016: “Moody's Investors Service Upgrades Burlington's Credit Rating Two Steps”

# # #